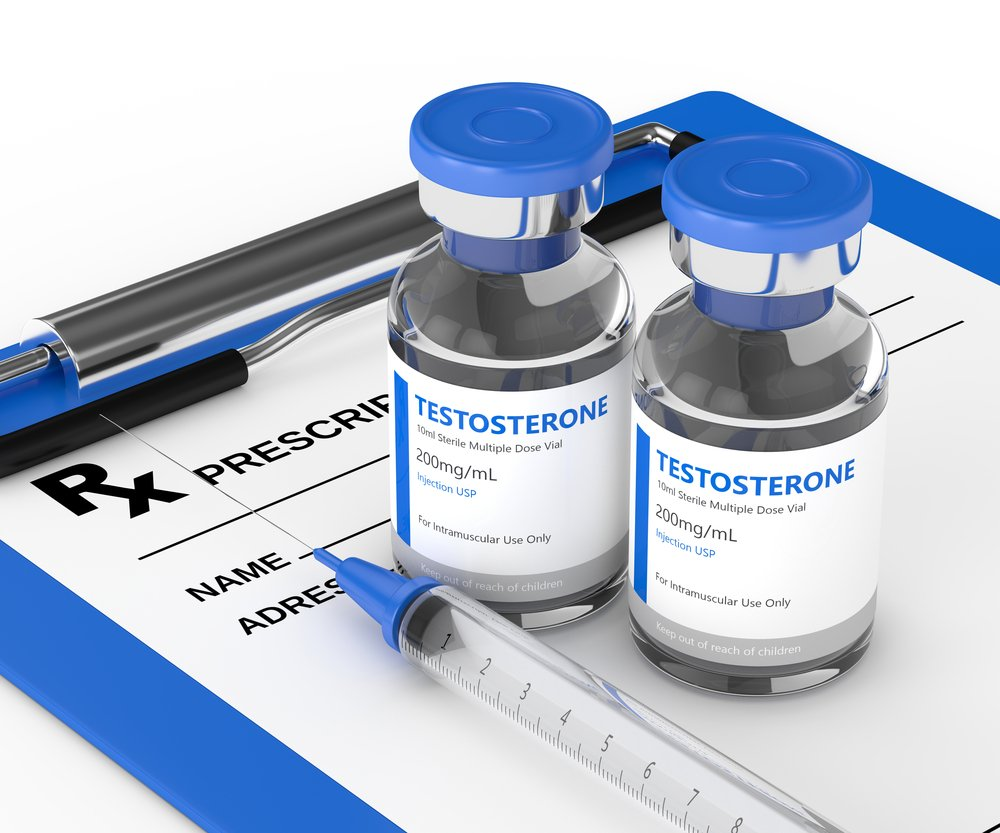

In an era where technology has become our ultimate guide, it’s no wonder that the digital landscape is heavily dotted with platforms and tools designed to help us manage our personal finances. The days of balancing checkbooks and tracking expenses by hand are far behind us, replaced by sleek apps and robust online platforms that do the heavy lifting, leaving us with more time to actually enjoy the fruits of our financial diligence. But with so many options available, which ones should you trust with your financial information? Here’s a curated list of the best online trt and platforms that can transform the way you approach personal finance.

Empower Your Budgeting with Mint

Mint has become synonymous with seamless budgeting. Acquired by Intuit, the same company behind TurboTax, this free platform syncs with your bank accounts, credit cards, and even certain bills to keep you informed about your financial health in real-time. With colorful charts and graphs, Mint visually represents where your money is going, making it easier to identify trends and adjust your spending.

Level Up Your Investing with Robinhood

If you have an appetite for investment, Robinhood is the answer. Known for making commission-free trading famous, this app provides a user-friendly experience for beginners and seasoned investors alike. From stocks and ETFs to options and cryptocurrencies, Robinhood’s simple interface and educational resources make it a powerful tool to grow your portfolio.

Jumpstart Your Savings Goals with Qapital

Qapital takes an innovative approach to savings by automating the process based on your goals and habits. With features like round-up rules for purchases and the ability to create custom savings “rules” (like the “IFTTT” model), Qapital makes it effortless to save money without even realizing you’re doing it. This app is all about saving with a purpose, whether it’s for a vacation, a new gadget, or an emergency fund.

Secure Your Financial Future with Personal Capital

For a comprehensive view of your financial life and investment portfolio, Personal Capital is the cream of the crop. This robust platform offers a combination of free money tools, like a net worth tracker and retirement planner, along with wealth management services that cater to high net-worth individuals. Personal Capital focuses on long-term financial goals and helps you build a strategic plan to achieve them.

Streamline Your Money with Acorns

Acorns rounds up purchases to the nearest dollar and invests the spare change into a portfolio of your choosing. This “micro-investing” approach makes investment incredibly accessible, even for those who have never considered it before. With options for retirement accounts and custodial accounts, Acorns empowers its users to invest with every purchase and watch their wealth grow over time.

In addition to these heavy-hitters, there are countless other tools and platforms that cater to specific financial needs, from student loan refinancing services to bill negotiation bots. The common thread among the best online finance tools is their ability to leverage technology to simplify an otherwise complex and often daunting aspect of life. By integrating these platforms into your financial routine, you can empower yourself to make smarter decisions and achieve your money-related goals with greater ease. Remember, the best tool is the one that fits seamlessly into your life and encourages positive financial behaviors without adding unnecessary stress.